Most of the professional cryptocurrency traders are trading on BitMEX. Therefore the platform is designed to fit the needs of professional traders, which makes it difficult for beginners to understand how BitMEX works. In order to help you understand how you can trade on BitMEX we created the following tutorial. If you don’t have a BitMEX Account yet feel free to use this link to sign up and save 10% on trading fees.

Background to BitMEX

BitMEX is currently the biggest platform worldwide for trading cryptocurrencies. On a regular day the trading volume on BitMEX exceeds 1 billion US dollar easily. However on BitMEX you are actually not trading real cryptocurrencies but contracts that are pegged to the price of the underlying asset (for example Bitcoin).

You can either short or long cryptocurrencies on BitMEX. Meaning you can speculate that the price will either go up or down. You can basically make money in both directions. In order to trade on BitMEX you need to deposit Bitcoins. That also means that you can only increase you Bitcoin stack with a successful trade.

BitMEX was founded by the 3 former Bankers Arthur Hayes, Samuel Reed and Ben Delo in 2014. The company is incorporated in the Seychelles however most of the team is located in Hong Kong. In order to trade on BitMEX you don’t need to verify your identity (no KYC). That is possible because all the withdrawals and deposits to and from BitMEX are made in Bitcoin. There is no Fiat gateway (Euro or USD) to BitMEX. Thus you need to own Bitcoin (BTC) in order to trade on BitMEX. There is also a restriction for US citizens to trade on BitMEX. All IPs from the US will get blocked automatically by BitMEX. If you are located in the US and you still want to trade on BitMEX you need to use a VPN service.

One of the main reasons why BitMEX is so popular in the crypto community is the leverage you can use to trade cryptocurrencies. For Bitcoin you can use a leverage of up to 100x. Meaning if you have one Bitcoin (no minimum required) you can enter a position worth 100 Bitcoins (either long or short).

Supported cryptocurrencies on BitMEX

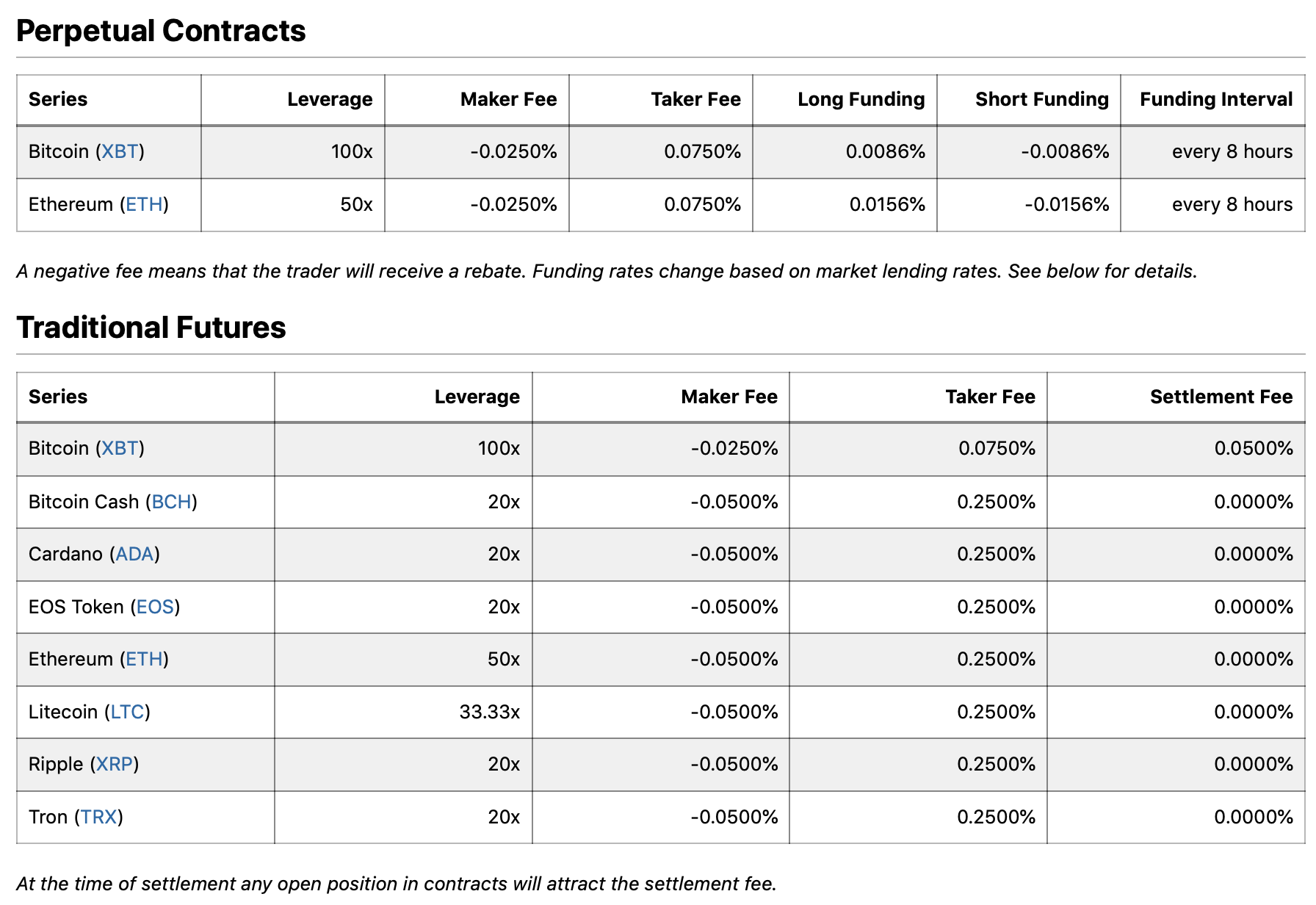

Here are the 8 cryptocurrencies that you can currently trade on BitMEX and the leverage you can use with them: Bitcoin (100x), Cardano (20x), Bitcoin Cash (20x), EOS (20x), Ethereum (50x), Litecoin (33x), TRON (20x), Ripple XRP (20x).

All cryptocurrencies are traded against Bitcoin on BitMEX so you need to deposit Bitcoins in order to trade them you can deposit Ethereum or any other cryptocurrency.

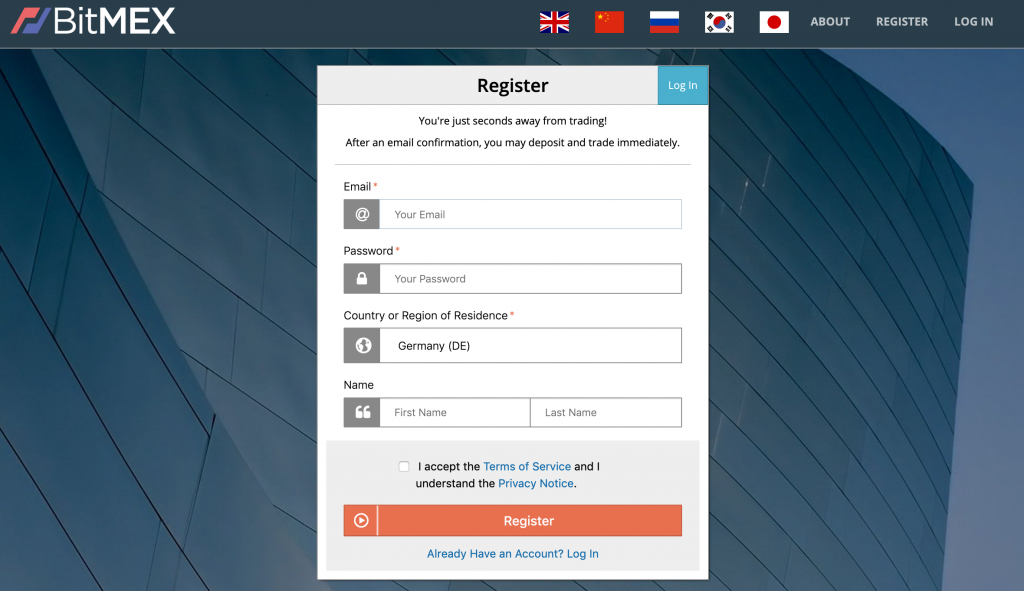

Registration

Opening up a BitMEX account is pretty easy. All you have to do is enter your email address and a password. After that you will receive an email in order to confirm your email address. A verification process like you have on other exchanges is not necessary (no KYC). Once your email address is confirmed you can start trading immediately.

To have a higher security we highly recommend setting up a 2-factor authentification as well. The best way to do it is to use Google Authenticator.

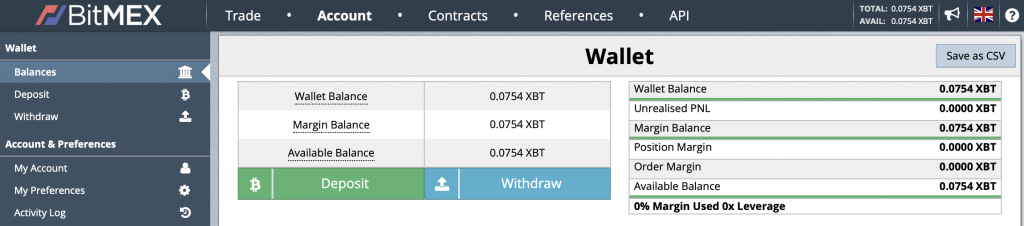

Deposits and Withdrawals

In order to trade on BitMEX you need to deposit Bitcoin, which is called XBT on BitMEX instead of BTC. All you need to do is click on “Account” in the top menu and then click on “Deposit”. Once you did that you will see a Bitcoin (XBT) address where you can send your Bitcoins to.

Usually you should see immediately after sending your Bitcoins that you have a new deposit on BitMEX. However it usually takes half an hour or longer until the deposit is finally confirmed (you need a couple of Bitcoin network confirmations) in order to start trading with it.

Withdrawals work similar. All you have to do to withdraw Bitcoins (XBT) from BitMEX is to click on “Withdraw”. The next step is just to enter a Bitcoin address where you want to send the Bitcoins to. Here it is important to know, that withdrawals are only processed once a day at 1 pm UTC. Thus if you request a withdraw at 1:30 pm (UTC) you have to wait almost 24 hours until the withdraw is processed.

Trading Tutorial

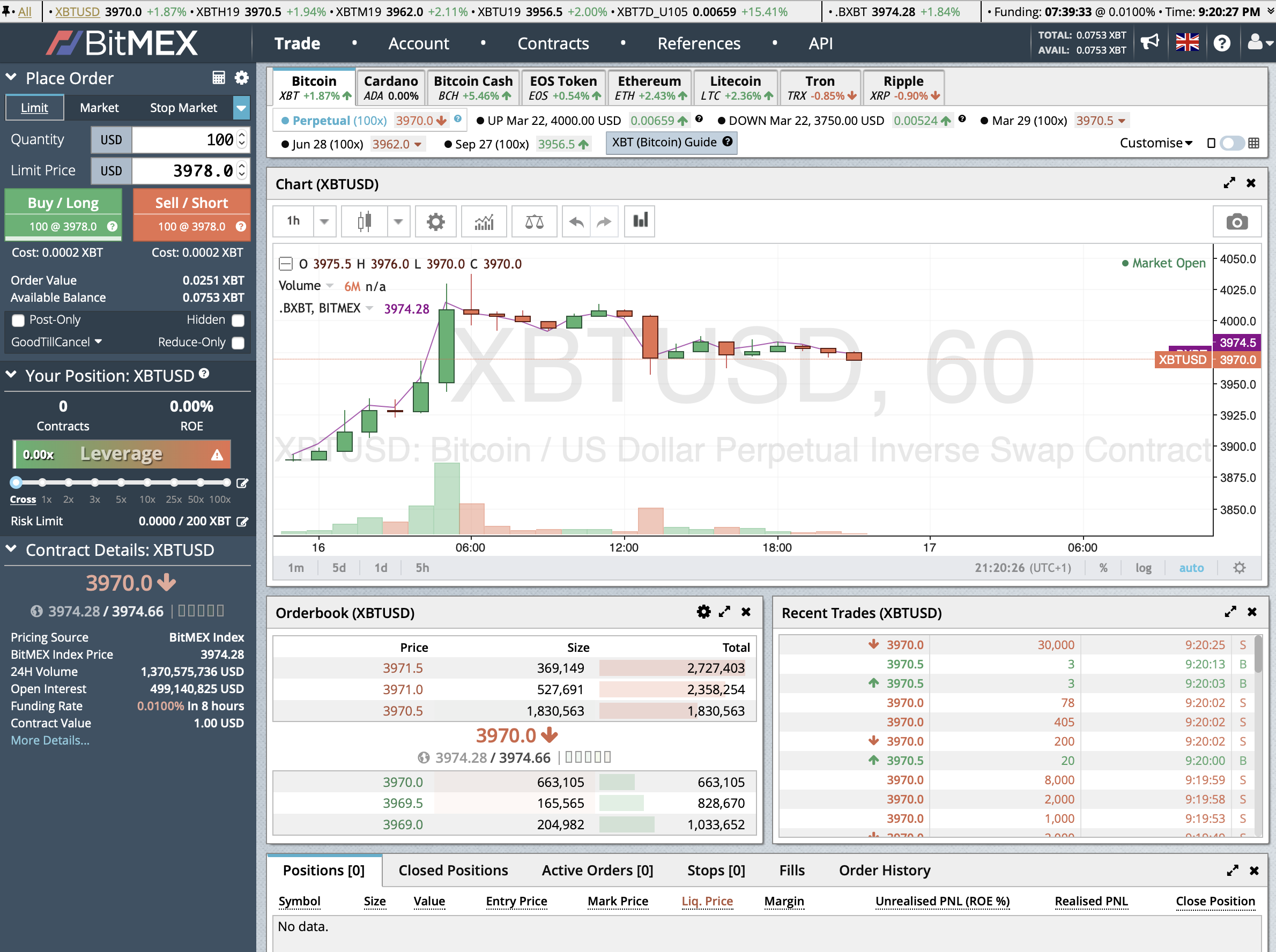

Once you are logged into BitMEX you can see the dashboard. Just by looking at the dashboard you should recognise that BitMEX targets more advanced traders instead of beginners. The dashboard can be quite confusing if you are new to trading. Thats why we wrote this tutorial to help you get started on BitMEX.

On top you can see different tabs. Each tab stands for a different coin that you can trade on BitMEX. Once you clicked on a tab of a currency that chart with the current price will open and you can see the orderbook and the last trades that happened on BitMEX. You can also see that there are sometimes different contracts that you can trade for a single currency. We will explain the different contract types later on.

On the left you can see an area where you can place your orders.There are different order types that you can use on BitMEX. You always have the option to go long (you think the price will go up) or to go short (if you think the price will go down). In order to go long you ned to click the green buy button once you have placed an order. If you want to go short you need to click on the red sell button after entering your order.

Limit Order: Here you can specify at which price your order should be executed. Please note that you need to enter the price of a full Bitcoin even if you are trading only half a Bitcoin or more than 1 Bitcoin. The order will only get filled if the price reaches your set “Limit Price”.

Market Order: If you choose a market order that means that your order will be executed immediately to the best price that is currently available on the market. All you have to do is enter how many contracts you want to buy.

Stop Market Order: This order helps you to limit your loses. You just need to set at stop price at which your position will be sold immediately.

Stop Limit Order: A Stop Limit Order is similar to a Stop Market Order the only difference is that you can set a limit price that you want to get once your stop is triggered.

Trailing Stop: This gives you the option to set a moving Stop Market Order. Meaning you can set a US dollar amount that the price can drop from the latest high. If the prices drops by the predefined amount a Stop Market Order will be executed.

Take Profit Limit Order: With a Take Profit Limit Order you can basically do the opposite of a Stop Order. It helps you to automatically sell your position or part of your position once a certain price level is reached.

Take Profit Market Order: Instead of a Take Profit Limit Order you can also do a Take Profit Market Order that will be executed once a certain price is reached.

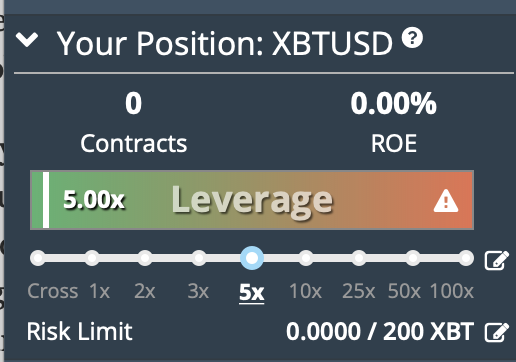

Leverage

One of the reasons why BitMEX is so popular in the trading community is because of the possibility to trade with high leverage. You can trade most cryptocurrencies on BitMEX with a leverage of 1:20 however for Ethereum you can use 1:50 and for Bitcoin 1:100. So you can basically open up a position worth 100 BTC with just owning 1 BTC. If the the price of Bitcoin would go up by 10% that would put your profit at 10 BTC (called XBT on BitMEX).

However if you are new to BitMEX we highly recommend not using a leverage above 1:5. You can select your leverage manually below the field where you enter your position.

With a leverage of 1:5 you can open a position worth 1 BTC with just having 0.2 BTC in your Account. But you have to be aware of the fact that you will get liquidated if the price drops by more than 20% (actually a bit less than 20% because some of the money goes to the BitMEX Insurance Fund). As you may have guessed it by now with a leverage of 1:100 you will be liquidated if the price drops by close to 1%.

Perpetuals, Futures and other contracts on BitMEX

The most popular contract on BitMEX is the Bitcoin perpetual contract. The name already suggests that the contract never expires so you could be in the position theoretically for an indefinite amount of time. However in order to stay in the position you have to pay funding (it could also be negative and you could receive money) every 8 hours. We will explain funding later on in the part about the fees.

The Bitcoin perpetual contracts are traded in US dollar on BitMEX so if you want to enter a position you have to enter the dollar amount that you want to trade. However the position you are trading is still only backed by the Bitcoins you deposited on BitMEX. The smallest position you can enter is 1 US dollar.

Example Calculation for a Perpetual Contract:

Assuming a trader enters a long position worth 10 XBT and the current Bitcoin price is at 4.000 US dollar (no leverage). In that case the trader would buy 40.000 contracts (1 contract = 1 US dollar). If the Bitcoin price would go up to 5.000 US dollar the trader would make a profit of 2 XBT. The trader would end up with 12 Bitcoins (XBT) in total. As you can see the trader not only profited from the Bitcoin price increase he also has more Bitcoins now.

Future Contracts

Besides the perpetual contracts there are also future contracts with a fixed expiration date. The future contracts usually end at the end of the quarter. That means when you buy a futures contract it will be either settled at the end of the quarter or the end of the next quarter. Thus with a futures contract you are actually betting on the price at the expiration date. Of course it is again possible to go long or short on the contract. In contrast to the perpetual contract you don’t have to pay funding every 8 hours when you buy a futures contract with a set expiration date. You just have to pay a fee when you buy the contracts. Thus if you are trading on longer time horizons it is usually more attractive to buy a futures contract than a perpetual contract.

Cost and Fees

Trading on BitMEX is not free. You still have to pay a fee almost every time you enter a position. However to withdraw or deposit money on BitMEX is free. Here are the current fees of BitMEX.

If you look at the fee structure of BitMEX you can see that there are two types of fees a maker and a taker fee. Which fee will applied basically depends on the type of order you are using. If you are using a market order that will be executed (filled) immediately you are paying the taker fee. As you can see the taker fee for the Bitcoin and Ethereum perpetual contract is 0.075%. In order to save money and get a better entry into your position you could also use a limit order. In comparison to the market order with a limit order you have to set a limit price at which the order will be executed. Let’s assume the current Bitcoin Price is at 7,021 US dollar you could set a limit order at 7,000 US dollar. The order will only be filled if the price drops to 7,000 US dollar. Thus a limit order will enter the order book and will only be executed once the current price reaches your limit price.

Please be aware of the fact that even if you set a limit order at current price and it will therefore be executed as a market order (because it gets filled immediately) you would have to pay the taker fee. Therefore the maker fee can only be applied if your order gets written into the order book and not get filled immediately. As you can see you actually have a negativ fee (-0.025%) for the maker fee. That means you actually receive money when you open a limit order that gets filled. Therefor you should most of the time try to enter a position with a limit order instead of a market order.

Besides the fee to enter a position you also have to pay funding when you are in a perpetual contract. Funding is payed every 8 hours and is also recalculated every 8 hours. You can see the current funding in the top menu on the right side (in the example below the funding rate is at -0.0007%).

The funding rate can either be positive or negative and is used to recalibrate the difference between shorts and longs. Thus lets assume the market sentiment is that the price will go up. That means most traders will probably be long and only a few traders will be short. To adjust for the difference between longs and shorts the funding rate has to be positive, which would mean that longs have to pay shorts every 8 hours. If the funding rate would be negative (like in the picture above) that would mean that shorts have to pay longs in order to stay in their position.

If you trade a Bitcoin futures contract you also have to know that there is a settlement fee when the contract expires.

In order to save fees you can use the following link to register on BitMEX and save 10% on trading fees in the first 6 month.

App for BitMEX

Unfortunately there is no app that you can use to trade on BitMEX. However the website has a responsive layout and therefore it is also possible to use the regular BitMEX website with a smartphone.

BitMEX Testnet (Account)

In case you want to practice trading first before you start to trade with real money BitMEX has you covered as well. You can just use the BitMEX Testnet in order to practice your trading skills. Thus in case of a losing trade you wouldn’t lose any real money. You can access the Testnet here: Testnet.Bitmex.com

Bot for BitMEX

When you hear the word BitMEX you also often here from bots that you can use to trade on BitMEX. It’s actually fairly easy to connect a bot to BitMEX because everyone with a BitMEX account can use the API to connect to the platform. However we tested a lot of bots in the past and didn’t find any bot that was able to continuously deliver good results. If you actually think about it if such bot would exist the profit the bot would be able to generate would go down with every new user that is using the bot thus it wouldn’t make sense to share the bot with other people. So don’t make the mistake and trust a bot with your trading.

Is BitMEX Secure?

One thing a lot of people wonder about is the fact if it is actually save to transfer part of your Bitcoin portfolio to BitMEX in order to trade there. To answer that question you have to know, that the daily trading volume of BitMEX is usually more than 1 Billion US dollar. So a lot of people already trust BitMEX with their Bitcoins and a lot of trading is already happening there. Besides that there wasn’t a single incident where a BitMEX user lost money on BitMEX due to a hacking attempt or something similar. Thus the platform was never hacked in the past. You also have to know, that most of the Bitcoins that are deposited on the platform are locked up in cold storage (more than 95%), which makes it impossible for a hacker to steal the Bitcoins. The cold storage is also the reason why withdrawals on BitMEX are only processed once a day.

To sum it up it is pretty secure to deposit your Bitcoins on BitMEX however that is no guarantee. Please also activate the 2 factor authentication when you use BitMEX to just use a password in order to log into your account is not very secure.

Video

In order to show you how BitMEX works we also made a video tutorial. In the tutorial you can see how you can enter and exit a position and we explain the different order types. So after watching the video you should be able to enter and exit positions on BitMEX on your own.

If you don’t have a BitMEX account yet feel free to use this link link in order to save 10% on fees in the first 6 month.